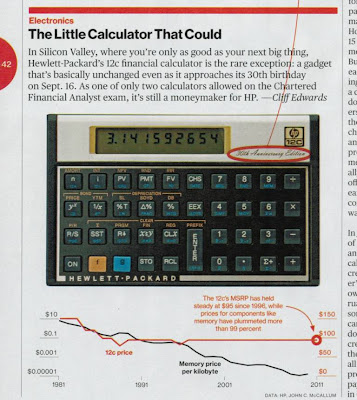

PHOTO: The HP-12C calculator I used to do the calculation mentioned in my letter below was featured in a 2011 article, on the 30th anniversary of the HP-12C financial calculator, by Cliff Edwards, "The Little Calculator That Could, HP's 12C: 30 years and (still) counting," Businessweek, Sept. 12 - Sept. 18, 2011, p. 42 See previous HP-12C posts HP 12c financial calculator history (6/21/06), HP-12C calculator 30th anniversary in BusinessWeek (9/16/11)

I mentioned that Medicare Part B premiums are rising faster than inflation in my previous letter: Thomas Kraemer, "Letter: Why my check will be less," Gazette-Times, Jan. 10, 2017, p.A6, posted Jan. 5, 2017, and my letter drew a response in another letter by Dr. Mike Huntington, M.D., "Single-payer is best option," Gazette-Times, Jan. 17, 2017, p. A6 gazettetimes.com posted Jan. 16, who is a local single-payer activist that blogs at Mad As Hell Doctors -Mid-Valley Health Care Advocates mvhca.org. (See previous posts Medicare premium rises faster than inflation despite 'single payer' method (1/7/17) for a copy of my original letter and also my previous post Calculation of Medicare premiums for Social Security beneficiaries revealed (1/13/17) where I document the actual 2017 premium costs)

Dr. Huntington's criticism, of my letter, included data from an older period of time that showed Medicare costs were not going up faster than inflation. When I calculated the most recent five years, the result confirmed the fact that Medicare Part B premiums have been rising much faster than inflation, just as Businessweek and others have noted, but these costs have been obfuscated by the small Social Security check cost-of-living increase, which limited how much of the increase is seen by each current recipient, but the increases are being seen by new enrollees. It took me awhile to dig up the actual data, based on actual Medicare and Social Security documents, and and after doing the research, I wrote the following letter in response:

The Medicare Part B premium during 2012-2017 rose at an annualized rate of 6 percent ($99.90 to $134) -- a rate greater than the prior 2000-2015 period cited in a Jan. 17 letter by Dr. Mike Huntington, M.D. and much more than the 1.36% Consumer Price Index of inflation rate (from Dec. 2011 CPI of 225.672 to Dec. 2016 CPI of 241.432) as calculated by an HP-12C calculator.

My concern is that this real and rapid rise in Medicare premiums will be politically exploited by Trump's Republican legislators and used as agitprop to dupe Americans into tolerating his "healthcare for all" plan that will likely privatize Medicare and replace Obamacare with "Health Savings Accounts," which primarily provide a tax break only to the healthy and wealthy.

The subsidies for Medicare make it a bargain for us current beneficiaries who worked and paid taxes for it, but in 2017 medicare.gov says some people will pay the full monthly health insurance premiums for Medicare Parts A, B and D of approximately $881, or $10,572 per year.

"Affordable healthcare" is legally defined by Obamacare as being annual health insurance premiums of less than 8.13 percent of "household income."

If you applied this Obamacare affordability standard to Medicare, it would mean the "annual household income" of Medicare enrollees paying the full cost would need to be at least $130,000.

In order to provide healthcare for all, the real question should be, what is the percentage of income that Americans are willing to pay?

Democratic Presidential candidate Bernie Sanders has made single-payer the centerpiece of his plan to save healthcare, but Sanders never explains why single-payer will control the infinite demand for healthcare, other than the usual negotiation reasons. In fact, I have found no article that covers this basic economic issue of how healthcare should be rationed in a fair manner. An overview article "Single-payer healthcare," From Wikipedia accessed Jan. 17, 2017 says, "There are pros and cons to this kind of system. Single-payer health care plan also known as "Medicare for all" is the type of health insurance where a single public agency organizes health care financing, however the actual delivery of care are still left largely in private hands."

The affordability of Medicare is put into perspective by BLS data on median incomes. "Median weekly earnings of the nation's 111.3 million full-time wage and salary workers were $849 in the fourth quarter of 2016 " according to the U.S. Bureau of Labor Statistics, Division of Labor Force Statistics, "Usual Weekly Earnings Summary," For release 10:00 a.m. (EST) Tuesday, January 24, 2017 bls.gov. This weekly amount equals a median annual income of $44,148, which would mean affordable health insurance premiums of 8.13 percent of household income would approximately equal $3,589 or $$299 per month for at least a half of Americans.

The official U.S. Government's tax collection agency page, "Individual Shared Responsibility Provision - Exemptions: Claiming or Reporting," irs.gov Page Last Reviewed or Updated: 13-Dec-2016 is where I first learned the fact that Obamacare ACA law says you don't have to pay a fine for not having healthcare if the cheapest health care premiums you can get are more than 8.05 percent for 2015 and for 2016 8.13% of your "household income." Of course, this penalty might not be collected in the future because of President Trump's recent Executive Order that asks Federal government officials not to force Obamacare costs on individuals. So far, nobody is sure it this is what he really means.

Finally, an indication of how Obamacare has been dividing both liberals and conservatives is the essay by Seattle alternative newspaper editor and sex columnist, Dan Savage, "Obamacare: Evil. Less Evil. But Still Evil.," thestranger.com posted Jan. 19, 2017, who is a Bernie Sanders supporter, but also gives an example of how people in need are getting nothing from Obamacare. Savage is an unrepentant liberal, but his criticism of Obamacare is very balanced.

See previous posts:

- Medicare premium rises faster than inflation despite 'single payer' method (1/7/17) includes a copy of my original letter Thomas Kraemer, "Letter: Why my check will be less," Gazette-Times, Jan. 10, 2017, p.A6, posted Jan. 5, 2017 - where I said, "Medicare is a "single payer" system and it is experiencing premium increases that are many times the overall rate of inflation, primarily due to inelastic demand for heroic end-of-life medical care that is costing more than a million dollars per person according to a "Bloomberg BusinessWeek" article."

- Calculation of Medicare premiums for Social Security beneficiaries revealed (1/13/17) - I document the 2017 costs

Listed below are links to the sources of information summarized in my letter above:

- "Part A costs: How much does Part A cost?" medicare.gov accessed Jan. 9, 2017 -- says, "You usually don't pay a monthly premium for Medicare Part A (Hospital Insurance) coverage if you or your spouse paid Medicare taxes while working. This is sometimes called "premium-free Part A. . . If you buy Part A, you'll pay up to $413 each month in 2017."

- "Part B costs," medicare.gov accessed Jan. 9, 2017 says, "If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty. . . Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago . . The standard Part B premium amount in 2017 is $134 (or higher depending on your income)."

- "Part B late enrollment penalty," medicare.gov accessed Jan. 9, 2017